does florida have an estate tax return

Florida a tax-efficient state does not have an inheritance tax. The types of taxes a deceased taxpayers estate.

Florida Estate Tax Guide Updated For 2021

You may still pay federal estate taxes if your estate meets the maximum established federally.

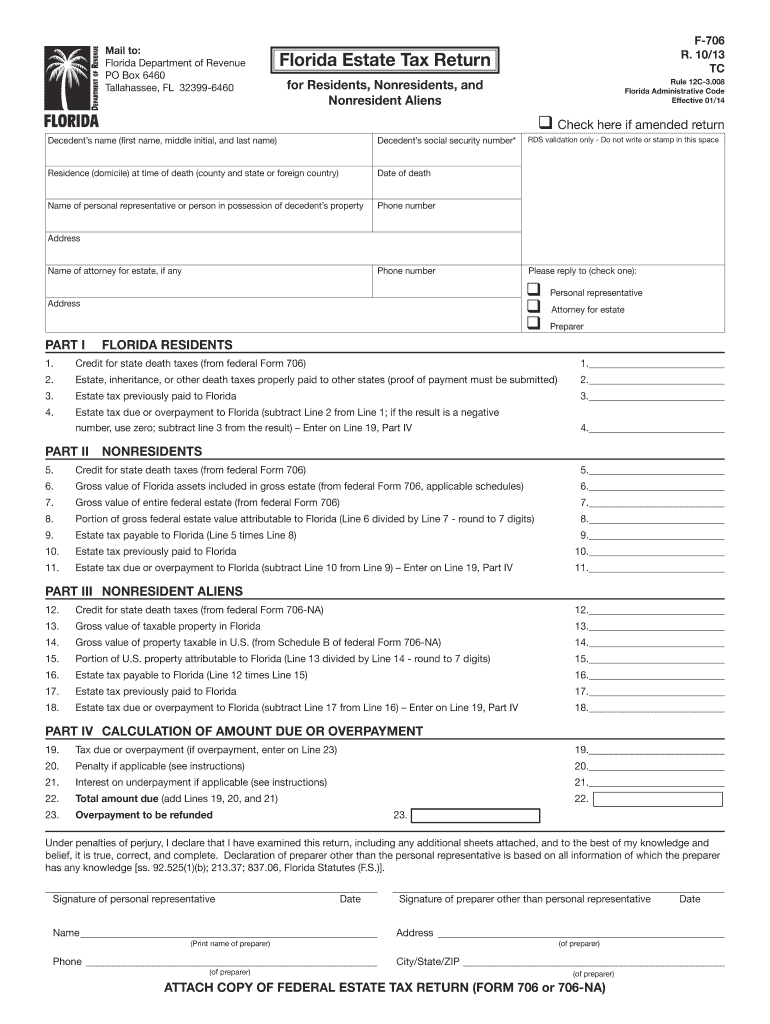

. Floridas general state sales tax rate is 6 with the following exceptions. In Florida theres no state-level death tax or inheritance tax but there is still a federal estate tax requirement so if an estate is valued at more than 11 million there is a potential federal. Florida Form F-706 and payment are due at the same time the federal estate tax is due.

What is the Florida estate tax lien. For estates of decedent nonresidents not citizens of the United States the Estate Tax is a tax on the transfer of US-situated property which may include both tangible and. Affidavit of No Florida Estate Tax Due.

Taxes on the federal return federal Form 706 is the amount of Florida estate tax due. The federal estate tax for the 2022 tax. If the following does not apply to you you are not required to file the return.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. Nine states Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming have no income taxes.

Florida s intangible personal property tax was an annual tax on the market value of intangible property such as. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. This applies to the estates of any decedents who have passed away after December 31 2004.

See what is deductible if you own a trust in the tax year 2018. Corporate income tax is reported using a Florida Corporate IncomeFranchise Tax Return Florida Form F-1120. Affidavit of No Florida Estate Tax Due When Federal Return is Required.

The strength of Floridas low tax burden comes from its lack of an income tax making them one of seven such states in the US. Discover the differences between the types of trusts and the ways the IRS will tax you if you have one. Under Florida statute 19822 there is an automatic lien against Florida estates for the purposes of ensuring that estate taxes are paid in.

New Hampshire however taxes. Corporations must file Florida Form F-1120 each year even if no tax is due. The state of Florida doesnt have an estate tax but that doesnt make you exempt from the Internal Revenue Services federal estate tax.

If an individuals death occurred prior to that time then an estate tax. If any of the. Florida Estate Tax Return for Residents.

The state constitution prohibits such a tax. Florida Inheritance And Estate Tax Definition Alper Law. Counties in Florida have the authority to levy an ad valorem tax on tangible personal property.

2013 2022 Form Fl F 706 Fill Online Printable Fillable Blank Pdffiller

Do I Need To File Tax Returns For The Estate Florida Probate Law Firm

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

![]()

Does Florida Have An Inheritance Tax Alper Law

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

The Ins And Outs Of The Florida Estate Tax The Florida Bar

Florida Attorney For Federal Estate Taxes Karp Law Firm

Do Inheritance And Estate Taxes Apply In Florida

Form F 706 Fillable Florida Estate Tax Return For Residents Nonresidents And Nonresident Aliens R 10 13

Iowa Estate Tax Everything You Need To Know Smartasset

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

What Tax Returns Must Be Filed By A Florida Probate Estate

Estate Tax Definition Federal Estate Tax Taxedu

Florida Estate Tax Rules On Estate Inheritance Taxes

12 Steps To Establishing A Florida Domicile Leech Tishman Legal Services